S&P 500 correction deepens as index drops 10% from its February peak. The market has fallen further as a result of investor concerns about stagflation and the effects of Trump’s tariff plans, which have led to sharp drops in major firms like Tesla, Walmart, and Amazon.

What’s Driving the Market Drop?

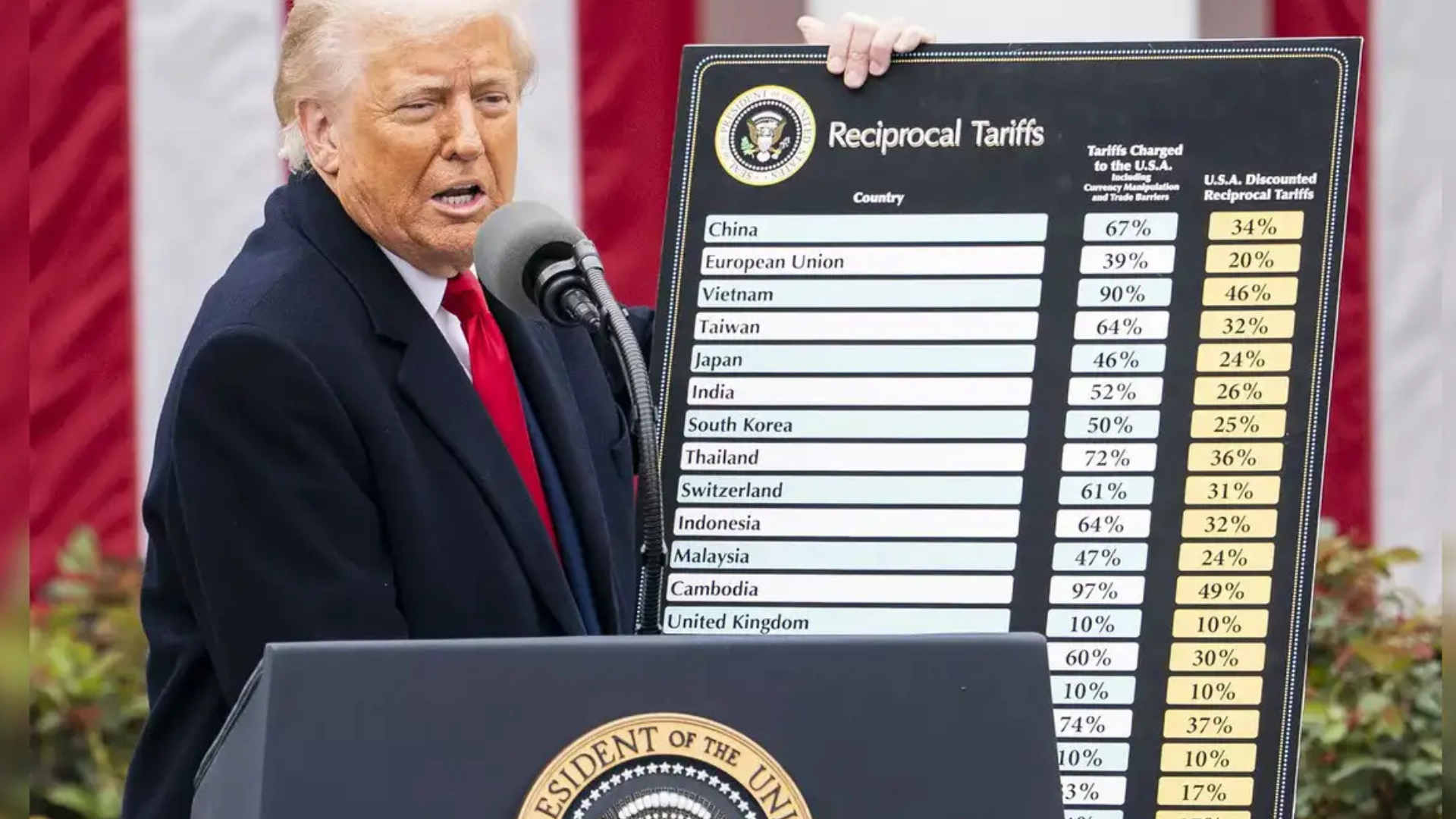

- Trump’s Tariff Threats: In response to European duties on American whiskey, President Donald Trump has escalated his trade battle by threatening to impose a 200% tariff on EU wine and champagne. This comes after his government imposed 25% steel and aluminum taxes, which have raised concerns about unstable global economies.

- Stagflation Risks: Despite Trump’s campaign pledges to cut prices, the most recent inflation data shows that price rises are still substantial. Investors fear that stagflation, which has traditionally harmed consumers and businesses, might result from sluggish economic growth and rising prices.

- Investor Uncertainty: The Nasdaq has already entered a correction zone, while the Dow Jones Industrial Average is lingering at the edge. Analysts disagree on whether this decline will turn into a bear market, which typically drops 20% and recovers more slowly.

What’s Up Next for the Market?

Treasury Secretary Scott Bessent downplayed concerns, saying the Trump administration puts long-term prosperity ahead of short-term turbulence. Market analysts warn that there haven’t been any notable economic tailwinds in 2025 and that there are still many unanswered questions regarding policy.

The Federal Reserve’s next inflation report will be closely watched by investors to see if the central bank adjusts interest rate policy in response to the continued volatility of the market.

Source: NBC News