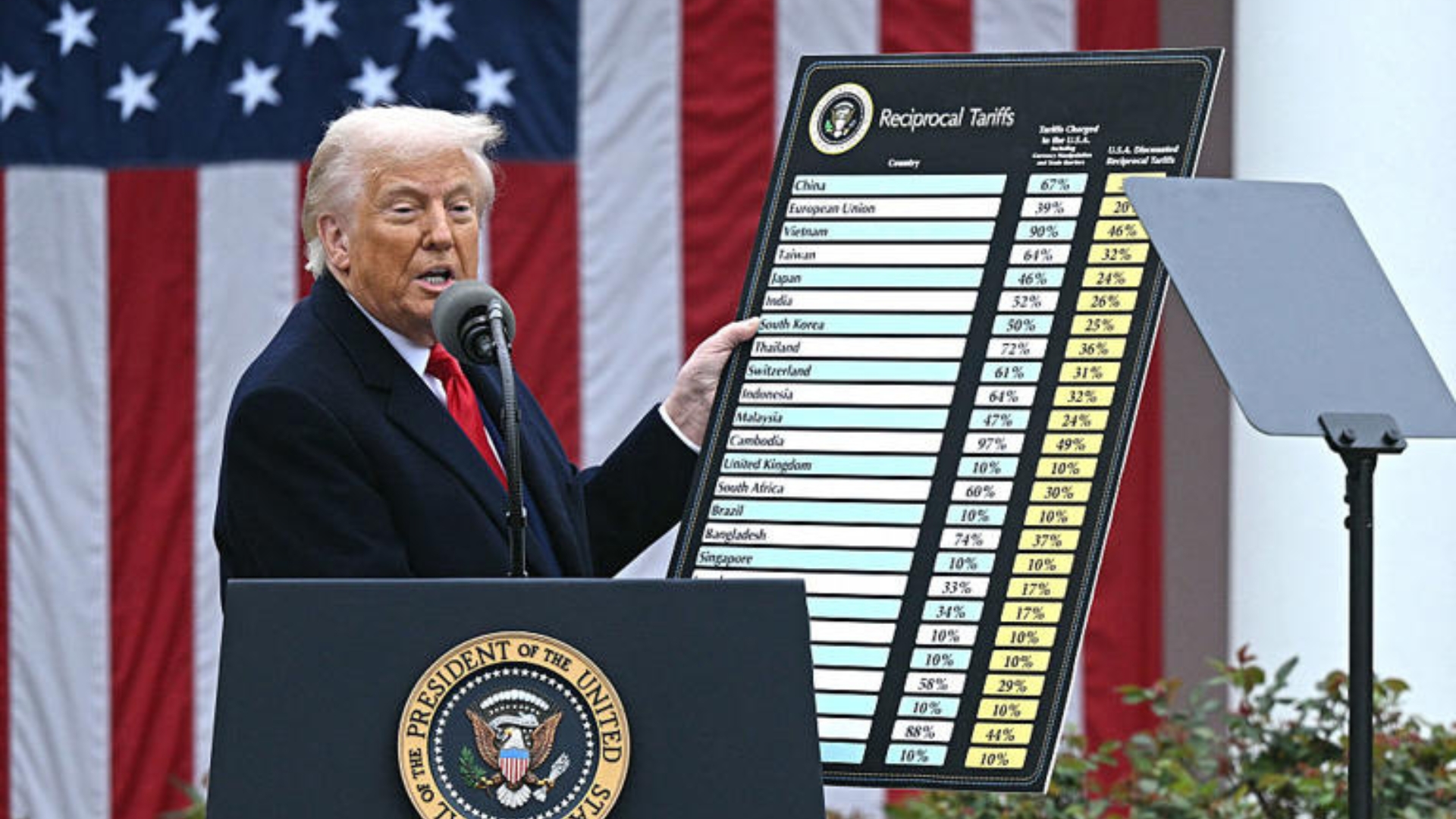

Asian shares mixed post-tumble: Stock markets showed mixed results as global investors grew skeptical about U.S. investments. This follows a massive decline in Wall Street, with President Donald Trump’s trade war and his controversial policies rattling the financial world.

Wall Street Tumbles, Impact Felt Globally

The previous day’s U.S. market plunge cast a shadow over global markets. The S&P 500 dropped by 2.4%, leaving the index 16% below its record high set just two months ago. The Dow Jones Industrial Average also experienced a significant loss, falling 971 points, or 2.5%. Notably, losses in tech stocks such as Tesla and Nvidia exacerbated the decline, contributing to a 2.6% drop in the Nasdaq composite.

Bonds and the US dollar decline, indicating global concerns

The U.S. dollar and U.S. government bonds both fell in an unexpected market trend. Treasurys and the USD have long been seen as safe-haven assets during volatile market times. However, the immediate effects of Washington’s actions have raised concerns and may undermine the reputation of American assets as the world’s safest investments.

Divergence in the Nikkei, Kospi, and Shanghai amid Asia’s Mixed Trading

The inconsistent trading outcomes for Asian markets were a reflection of the global volatility. In Japan, the Nikkei 225 lost 0.3%, closing at 34,174.38. Meanwhile, Australia’s S&P/ASX 200 remained virtually unchanged, edging up by 0.1% to 7,820.20. South Korea’s Kospi posted a modest gain of 0.2%, reaching 2,493.19. Hong Kong’s Hang Seng dipped slightly by less than 0.1%, while the Shanghai Composite saw a 0.3% increase, closing at 3,301.59.

Investor Wariness in the Face of Worldwide Uncertainty

Asian shares mixed post-tumble: Trading in Asia reflects global hesitancy over Trump’s escalating trade war and U.S. economic concerns. Many investors have reevaluated their tactics as a result of the uncertainty; others have chosen to invest in safer markets outside of the United States.

Source: AP News